lorenpfx804759

About lorenpfx804759

Understanding $500 Cash Loans With No Credit Check: An Observational Research

In as we speak’s quick-paced monetary setting, the need for quick cash solutions has become increasingly prevalent. Among the myriad of financial products out there, $500 cash loans with no credit check have emerged as a preferred choice for individuals going through unexpected expenses or money circulation challenges. This observational analysis article aims to discover the characteristics, implications, and shopper behaviors associated with these loans, shedding gentle on their position within the broader financial landscape.

The Attraction of $500 Cash Loans

The first allure of $500 cash loans with no credit check lies of their accessibility. For individuals with poor credit histories or these who’re new to credit, conventional lending options can often be out of reach. If you have any issues concerning where by and how to use online loans no credit check bad credit (bestnocreditcheckloans.com), you can speak to us at our web-site. In contrast, no credit check loans present a simple solution for individuals who want immediate funds with out the lengthy approval processes sometimes associated with conventional loans. This immediacy is particularly interesting in conditions such as medical emergencies, automotive repairs, or unexpected payments, where well timed access to cash is crucial.

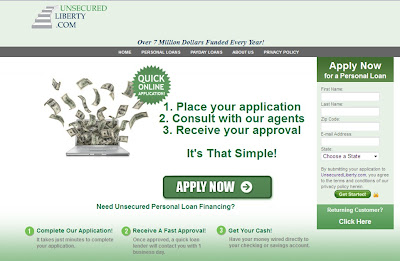

The Strategy of Obtaining a No Credit Check Loan

The method for securing a $500 cash loan with no credit check is mostly streamlined and person-friendly. Borrowers usually start by filling out an internet utility, which can require basic personal info, proof of income, and checking account particulars. Unlike conventional lenders, who often delve right into a borrower’s credit history, lenders providing no credit check loans concentrate on the applicant’s present monetary situation and capability to repay the loan.

As soon as the application is submitted, approval can often be granted within minutes, with funds deposited instantly into the borrower’s checking account shortly thereafter. This fast turnaround is a major issue driving the popularity of those loans, as it alleviates the stress of monetary emergencies.

Consumer Demographics and Motivations

Observational knowledge signifies that the demographic profile of borrowers seeking $500 cash loans with no credit check is numerous. Many borrowers are younger adults, usually in their 20s and 30s, who may lack established credit score histories. Additionally, individuals from lower-income brackets are regularly represented, as they could discover themselves in need of fast money to cowl important bills.

Motivations for looking for these loans vary, however widespread reasons embody the need for pressing money for medical payments, automobile repairs, or to bridge the hole between paychecks. In lots of instances, borrowers report feeling trapped in a cycle of financial instability, where unexpected expenses can lead to late charges, overdraft prices, and additional debt.

Dangers and Issues

While the convenience of $500 cash loans with no credit check is undeniable, they include inherent risks that borrowers must consider. One of the most significant concerns is the excessive-curiosity rates typically related to these loans. Lenders usually charge exorbitant fees, which may result in a cycle of debt if borrowers are unable to repay the loan inside the stipulated timeframe.

Additionally, the lack of credit score checks implies that lenders may not adequately assess a borrower’s capability to repay the loan, resulting in potential default. Borrowers could find themselves in a precarious state of affairs, the place they take out further loans to cowl the preliminary loan, making a cycle of borrowing that can be difficult to flee.

The Affect on Monetary Health

The implications of relying on $500 cash loans with no credit check prolong beyond quick financial relief. Observational research recommend that frequent use of these loans can negatively impression a borrower’s long-term financial health. Individuals who rely on such loans could miss alternatives to build credit, as they often don’t report repayment to credit bureaus. This lack of credit historical past can hinder future borrowing choices, limiting entry to more favorable loan merchandise down the line.

Furthermore, the stress associated with managing multiple loans can take a toll on psychological health, contributing to anxiety and monetary distress. Many borrowers report feeling overwhelmed by their monetary situations, leading to a cycle of borrowing that exacerbates their issues moderately than offering an answer.

Alternatives to No Credit Check Loans

Given the potential pitfalls of $500 cash loans with no credit check, it is essential for shoppers to explore various choices. For those going through short-term financial difficulties, options such as personal loans from credit score unions, community help packages, or even negotiating payment plans with creditors might present more sustainable options.

Building an emergency fund, even a small one, can also function a buffer in opposition to unexpected expenses. Financial education assets, together with budgeting workshops and credit score counseling, can empower people to make informed monetary selections and keep away from the pitfalls of excessive-curiosity borrowing.

Conclusion

In conclusion, $500 cash loans with no credit check provide a quick resolution for individuals in want of fast funds. Nonetheless, the convenience of entry comes with vital risks that may impression borrowers’ lengthy-time period financial well being. As customers navigate their financial options, it is essential to weigh the advantages towards the potential penalties and consider various pathways to monetary stability. Continued schooling and consciousness round accountable borrowing practices will probably be essential in helping people make knowledgeable selections that align with their financial effectively-being. Because the panorama of lending continues to evolve, understanding the implications of no credit check loans will stay a vital aspect of personal finance for many people.

In an era where monetary literacy is increasingly important, fostering a culture of knowledgeable borrowing may help mitigate the risks associated with quick cash loans, finally leading to healthier monetary futures for customers.

No listing found.